- Interent Capital

- Posts

- A Mental Model for the 2025 Crypto Bull Run

A Mental Model for the 2025 Crypto Bull Run

BTC is the best performing asset of 2025 YTD so far btw

gm friends —

After a brief hiatus, Internet Capital is back. Crypto markets are heating up again and I have a new mental model to keep me on track during the bull run.

BUT FIRST, AN IMPORTANT DISCLAIMER FOR THE READER!

Internet Capital is no longer a crypto-only operation. While crypto is still a primary focus, isolating crypto from other emerging technologies and trends (AI, e-commerce, creator economy, etc.) is limiting.

It’s the synergies between developing technologies that will impact the world most, and it’s important to understand each of them and how they interact.

So from now on I’ll cover anything interesting in the technology world (especially as it relates to the internet). As simple as that.

To learn more about what’s currently going on in the crypto markets check out our last podcast episode:

A Mental Model for the 2025 Crypto Bull Run

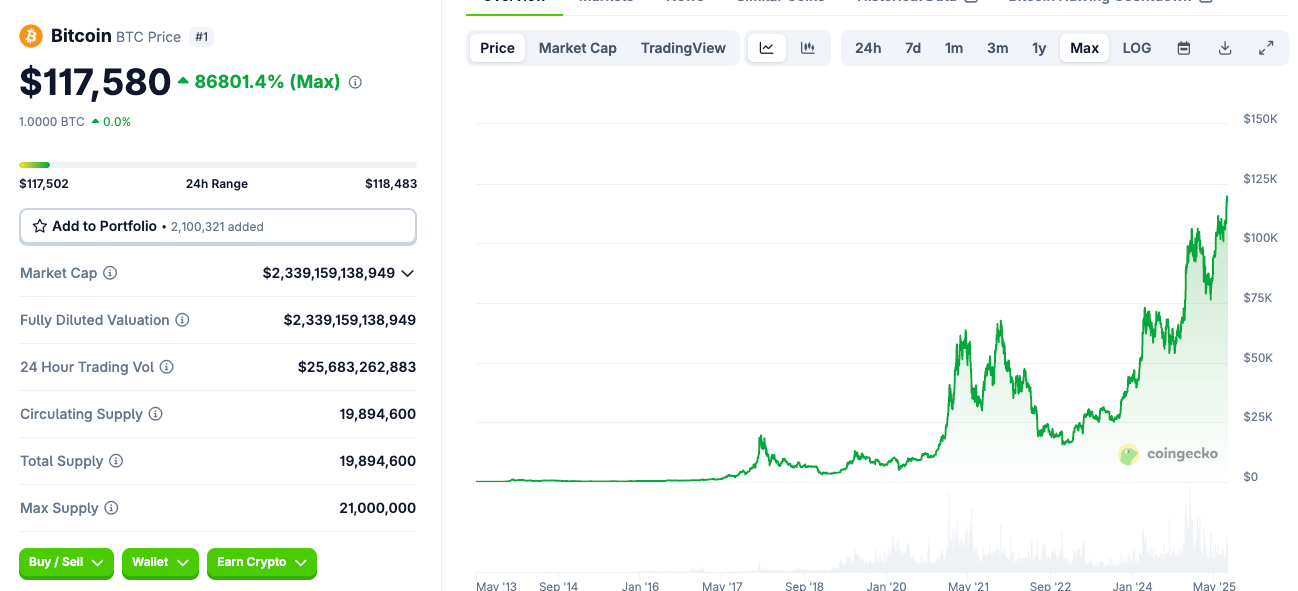

Crypto is in the middle of a massive, decade-long bull run. Just look at the Bitcoin price chart.

It has been essentially up-only since about 2022 and has been the best asset of 2025 so far YTD (up ~30%), with no signs of slowing up.

What’s most interesting to me is that BTC price is following an exponential curve over multiple years. On the curve, mini bubbles / manias periodically occur, creating what we call “cycles” in crypto.

To make this point more obvious, we smooth the data by taking a moving average. What emerges is a very clear exponential curve with a few bumps where the mini bubbles happened.

BTC Price (52-Week MA)

I think this “exponential curve with mini bubbles” is actually a great mental model for crypto investing. It cuts through a lot of the social media BS.

Its common to get overwhelmed by crypto investors/influencers (“investorfluencers”) telling you that you need to know EXACTLY when to buy and sell to maximize your returns before the precious bull run ends.

But they’re just playing the “time the crypto mini bubble” game. While there’s a lot of money to be made in this, it’s difficult. Most will end up losing their money.

Crypto Investorfluencers

Alternatively, you can simply recognize that crypto as an asset class is in the middle of an exponential adoption curve. Forget about timing the mini bubble, just ride the last half of the exponential curve (its where most of the gains happen anyways over the next 5-10 years

One important caveat - asset selection matters A LOT in this game. The vast majority of crypto assets go to zero and not every coin will benefit from accelerating crypto adoption over the coming years.

The good news is that the winners (and ultimate beneficiaries from the exponential curve) are fairly obvious. They’re crypto’s biggest assets and are being actively promoted by the biggest politicians and financiers in the world.

TLDR News Stories

“Crypto Week” in Washington - the House Committee on Financial Services designated the week starting July 14 as "Crypto Week”. MASSIVE progress was made on getting crypto legislation passed:

The GENIUS Act - received Senate approval in June but was passed by the house and signed into law by Trump this week. The bill sets up the first federal framework for stablecoins focusing on issuer rules, consumer protections, and backing requirements

The CLARITY Act - clarifies which digital assets count as securities versus commodities, shifting oversight from the SEC to the CFTC and laying out guidelines for exchanges, brokers, and dealers to make the market more transparent. Was passed in the house this week and is heading to the senate.

The CBD anti-Surveillance State Act - blocks the FED from rolling out a retail central bank digital currency without Congress’s approval. Was passed in the house this week and is heading to the senate.

ETH Price Explosion - Ethereum's price increased by over 25% this week, briefly topping $3,825 before settling, fueled by a perfect storm of institutional demand, regulatory tailwinds from Washington's "Crypto Week," and social momentum. Key contributing factors include:

Record ETF inflows totaling $2.18 billion for the week, with BlackRock's iShares Ethereum Trust (ETHA) and Fidelity leading the charge at over $7 billion combined since launch, marking the best day for ETH funds in 2025

Surging institutional interest, including treasury buys and derivatives activity, alongside growing adoption in tokenization and settlement infrastructure

Broader market buzz and technical strength, with ETH breaking key resistance levels like $3,700 amid ultra-bullish sentiment on X, whale accumulation, and anticipation of further upgrades like staking ETFs.

Coinbase Wallet Rebrands to Base App - Coinbase Wallet underwent a full rebrand to “Base App” this week, evolving from a simple self-custody wallet into a comprehensive Web3 "everything app" built on the Base L2 chain. The update includes social features, payments, trading, and mini-apps, aiming to unify crypto experiences and drive mass adoption amid surging Base activity.

Thanks for reading!

Don’t want to fall behind in crypto? Subscribe, follow us on X and check out our YouTube Channel to never miss an update!

Nothing in this newsletter is meant to be taken as legal, tax, investing, or other advice. Internet Capital is for educational and entertainment purposes only. All views are our own, and not representative of any organizations with which we are affiliated. For any business partnerships please reach out via the email [email protected]

Reply